The Importance of Tracking and Reporting

For a field that lives and dies by the numbers—the data—we at the Diverse Asset Managers Initiative have been struck by the relative absence of tracking and reporting of a crucial dataset: who is managing the assets.

Too much of the conversation in this area is spent around anecdote, not data. If the maxim “that which is measured matters” has truth, then it’s hard to make the case that institutions care much about the demography of who manages their money, if they can’t or won’t track and report that fact.

DAMI is launching an effort to rectify this; to change the culture in asset management to the point where tracking and reporting, like in all other areas of procurement, is the norm.

We will increase our efforts to help public, corporate, faith and labor union pension funds as well as foundation and university endowments build a culture of tracking and reporting women and diverse asset allocators utilized on an annual basis in order to better understand obstacles as well as opportunities for growth. We are agnostic as to whether the institution reports ownership, or profile of senior management, or even the demography of the teams working on the management: our goal is to make tracking and reporting safe and harmless and, well, normal.

The importance of tracking and reporting includes:

Creating a baseline in utilization of diverse managers

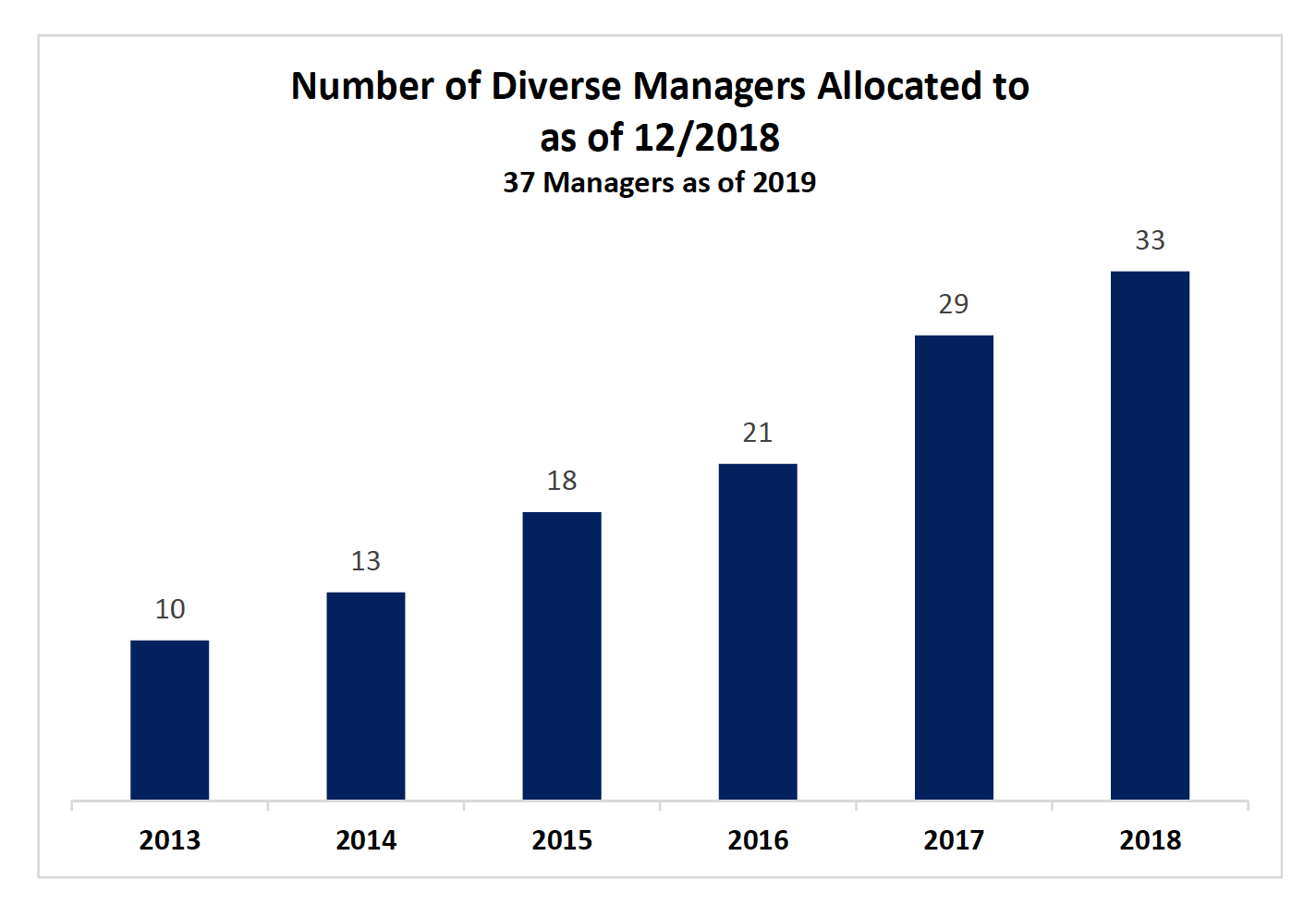

Tracking increases in allocations to diverse firms

Identifying obstacles in due diligence or allocations

Monitoring your investment consultant

How to Track and Report

The following are a few examples, within different industries, of organizations that have begun implementation of tracking and reporting metrics:

Knight Foundation

MacArthur Foundation

The California Endowment

Georgetown University

New York State Common Retirement

Teachers Retirement System of Illinois

Exelon

Crewcial Partners

Portfolio Advisors

They report different aspects of the cohorts, with different priorities, and of course there is no uniform methodology. But that’s not the point; they track, they report, and they are successful institutions.

We present in this dynamic report the details of how institutions report, and some narrative about the how and why from key leaders.

We encourage you as leaders to join them.

Knight Foundation

Since 2010, Knight Foundation has intentionally sought diversity in the ownership of the asset management firms where it invests. As of June 30, 2018, the foundation had invested $830 million with firms that are substantially- or majority-owned by women or minorities, representing 36 percent of its endowment.

MacArthur Foundation

The Just Imperative: First Update

Our Investments

We have identified minority- and women-owned investment management firms and firms where people of color or women are key principals, to be sure that we are considering all firms that meet our investment criteria; we are committed to doing more.

To date, we have invested directly or indirectly in 13 funds with managers that are minority- or women-owned, or where women or people of color are key principals, including African Americans, Asians, and Latinx, with total committed capital of nearly$500 million.

With an initial $50 million, we established a new fund with a major investment management firm to help identify and invest in minority- or women-owned managers whose assets under management or long-term performance do not yet meet our investment criteria, and to help identify firms that we might invest in directly.

We maintain a watch list of other diverse firms that may become open to investment, increase their assets under management, or improve long term-performance records to meet our investment criteria.

We have alerted our external investment managers to our commitment to diversity among key staff.

We ensure that our candidates for paid internships in our investment department include women and people of color.

Teachers Retirement System of Illinois

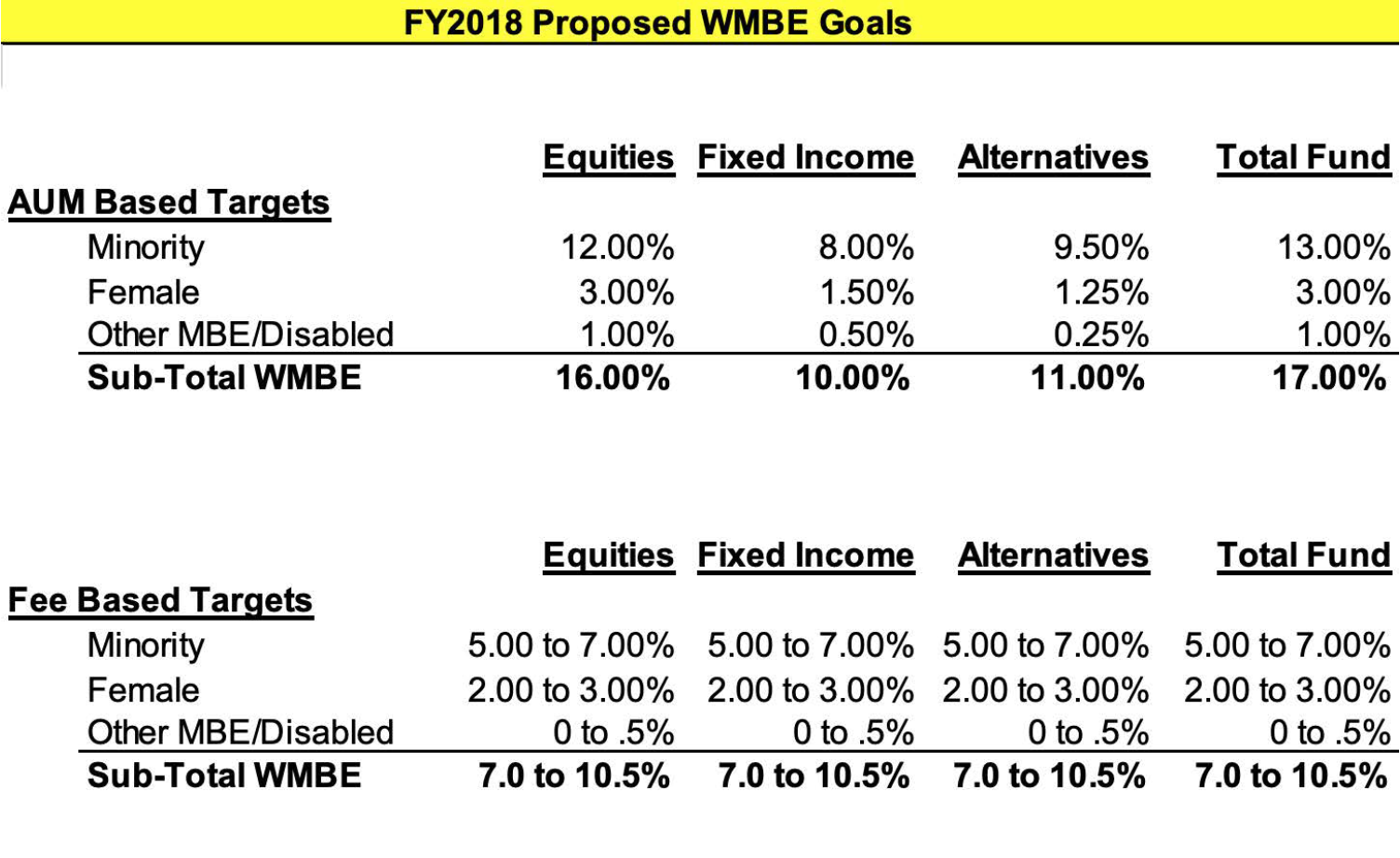

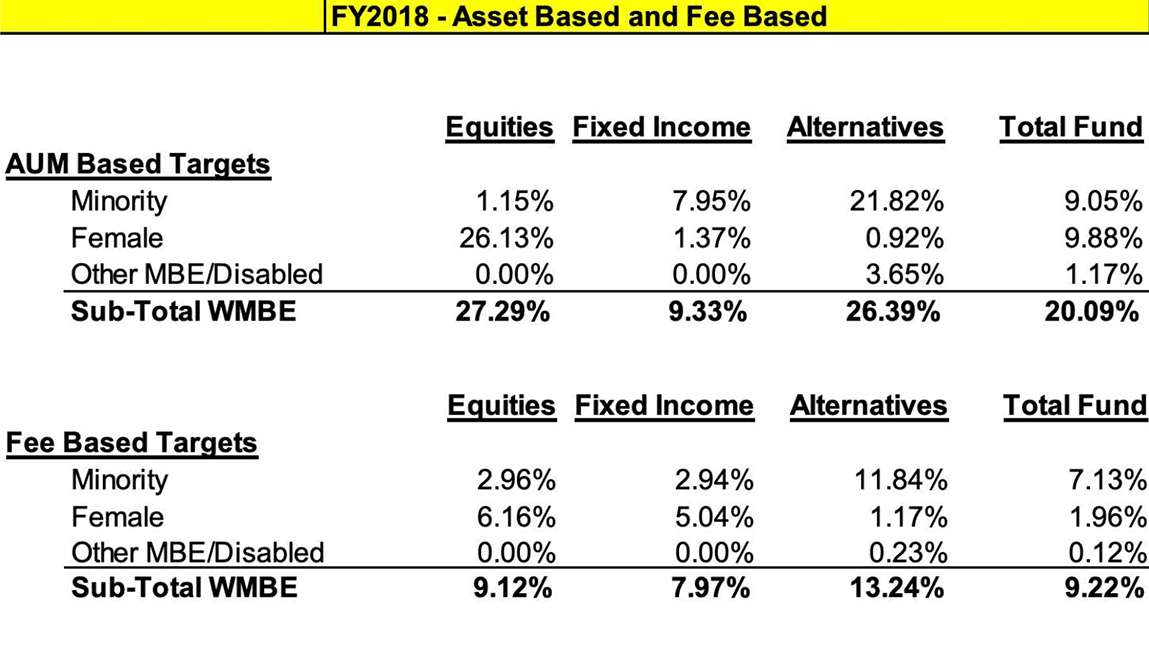

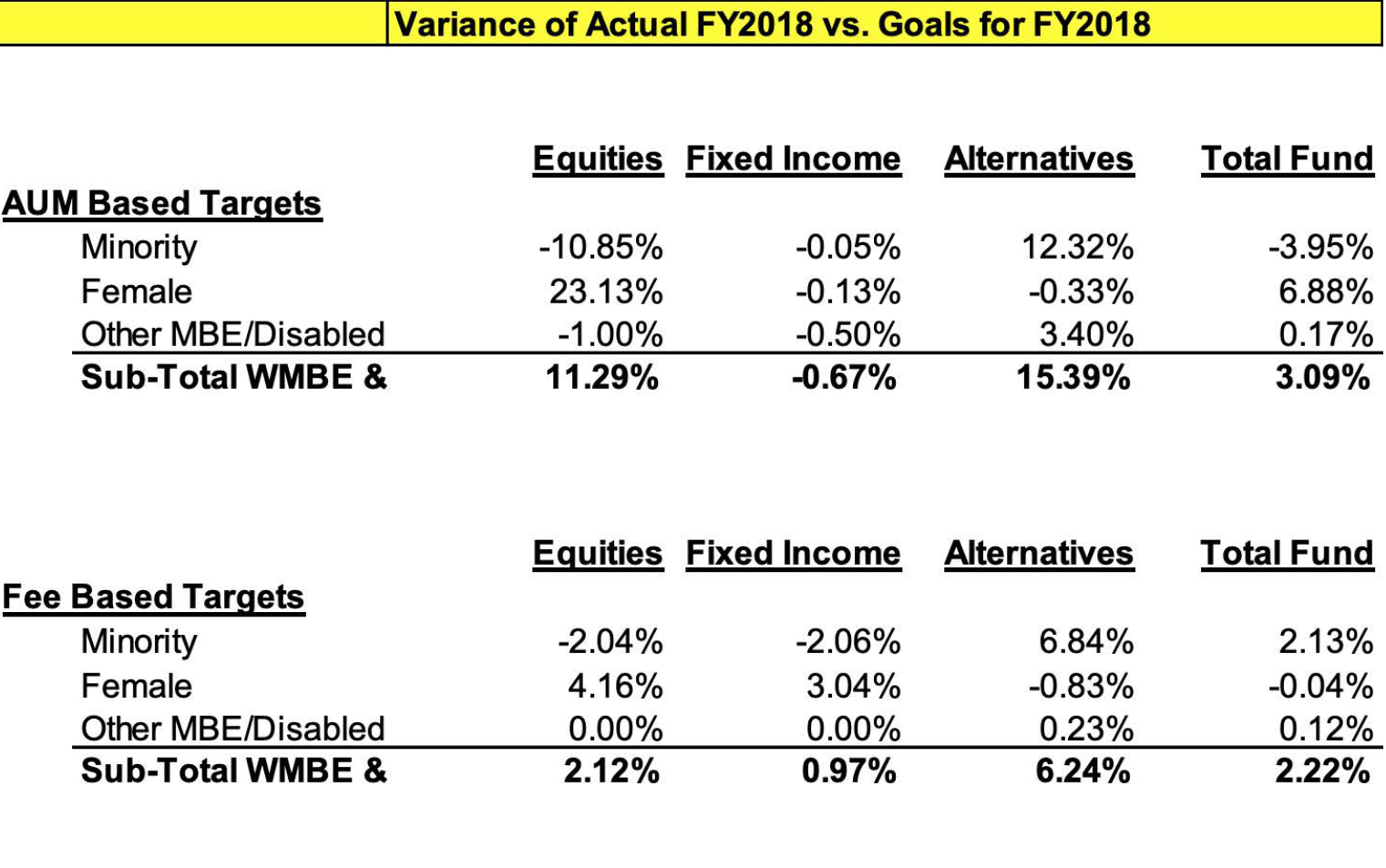

WMBE Goals Adopted by the TRS Board of Trustees

Goals adopted by the TRS Board of Trustees for Fiscal Year 2018. The Board of Trustees, at the October Board Meeting, will review goals for Fiscal Year 2019. Actual FY2018 figures are preliminary and unaudited.

As of June 30, 2018, The WMBE Percentage of Fund is 20.19%

Exelon

Crewcial Partners

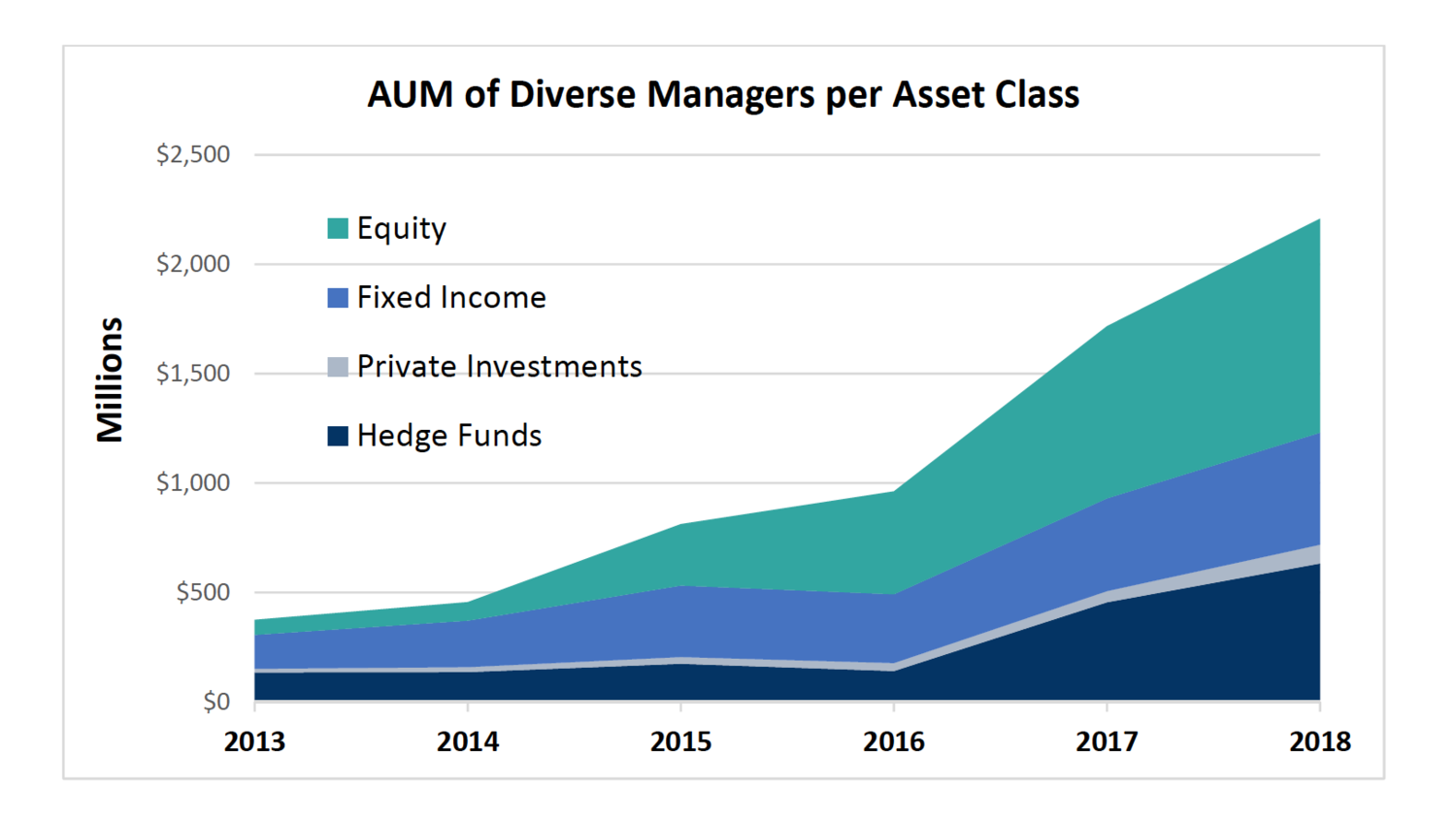

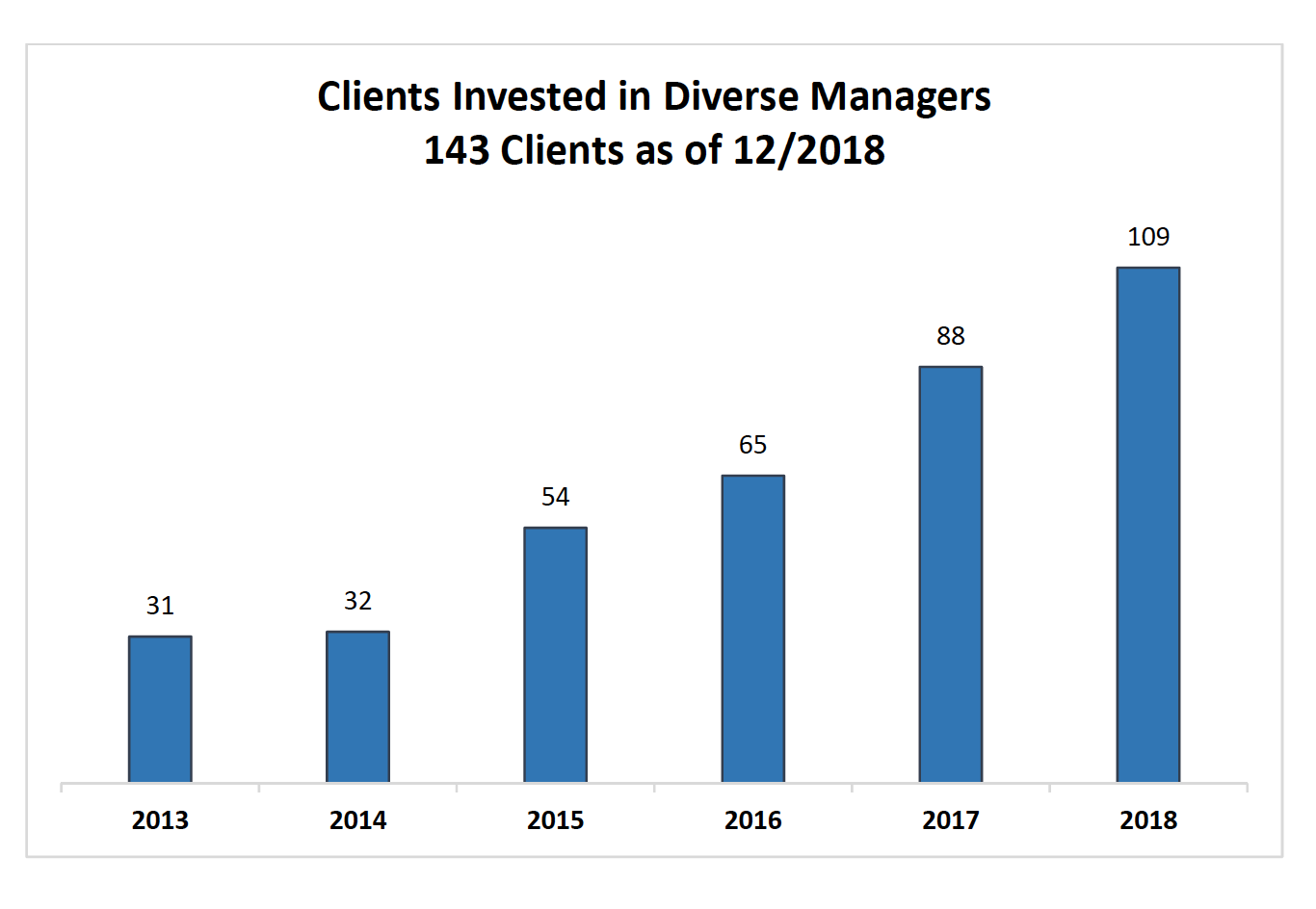

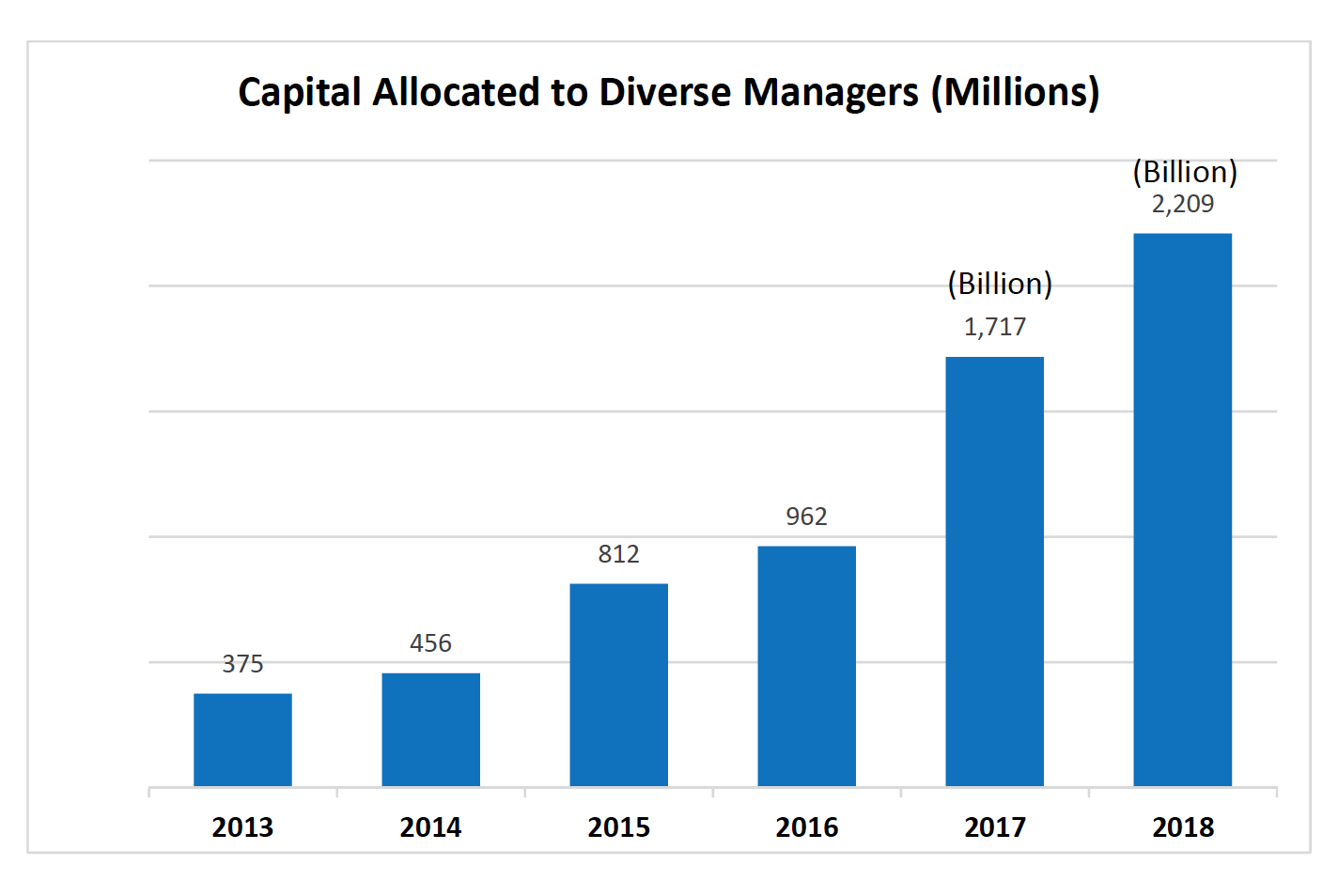

"We confronted and examined our hidden biases and concluded that by measuring and valuing diverse managers in our manager selection process, part of the initiative includes data collecting and statistical reporting to learn if managers possess a significant equity stake at one's firm. We believe a 51 percent or greater level of ownership equity should mean that the portfolio decision-making process is largely held by such diverse individuals. Coupled with meaningful allocations, diverse managers should be able to scale on multiple levels. Such asset management firms who may not possess this level of equity ownership should work to build a diverse investment management team. Otherwise, those lacking in this area will fail to capitalize on the diversity of thought representative of every corner of our society.

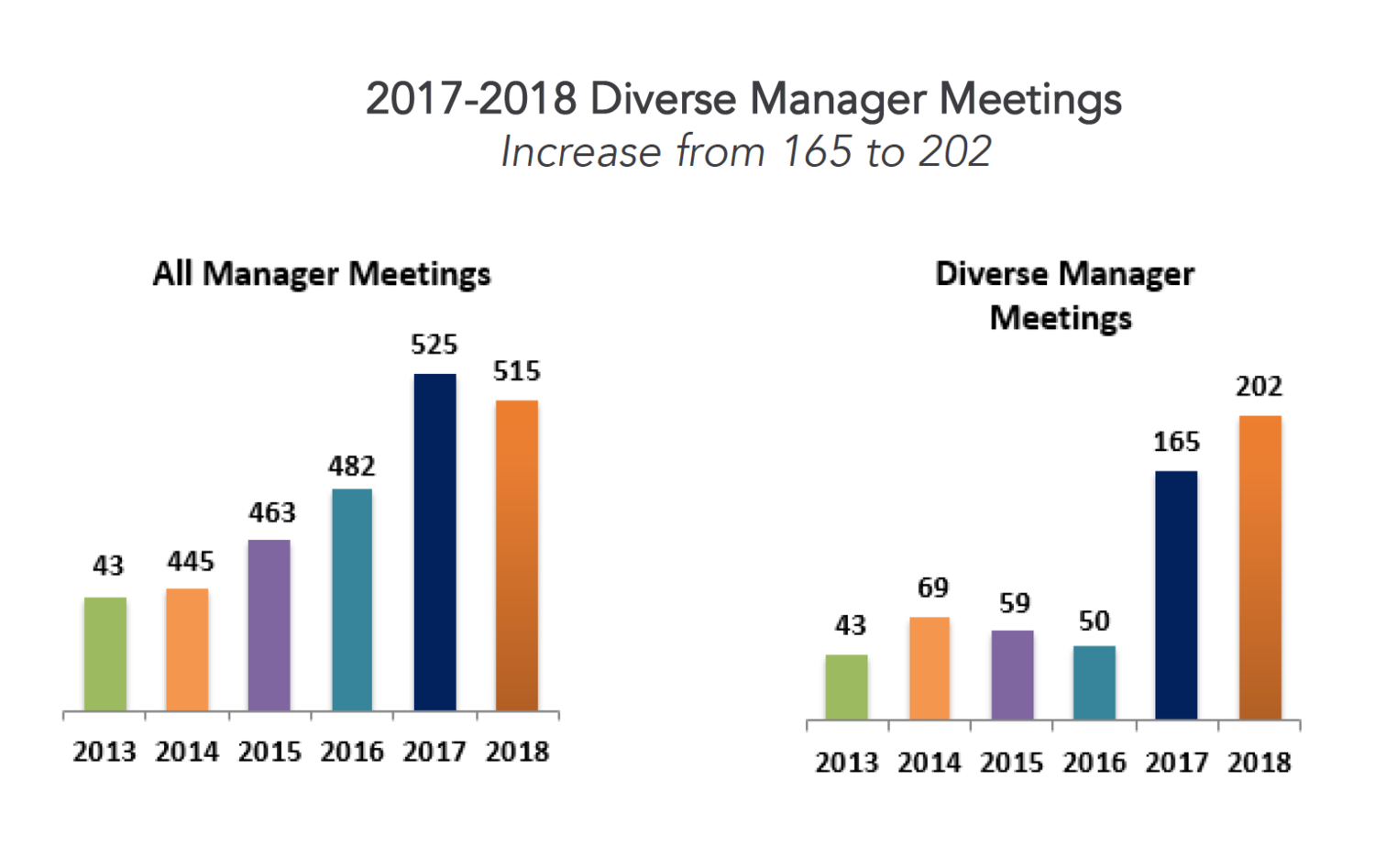

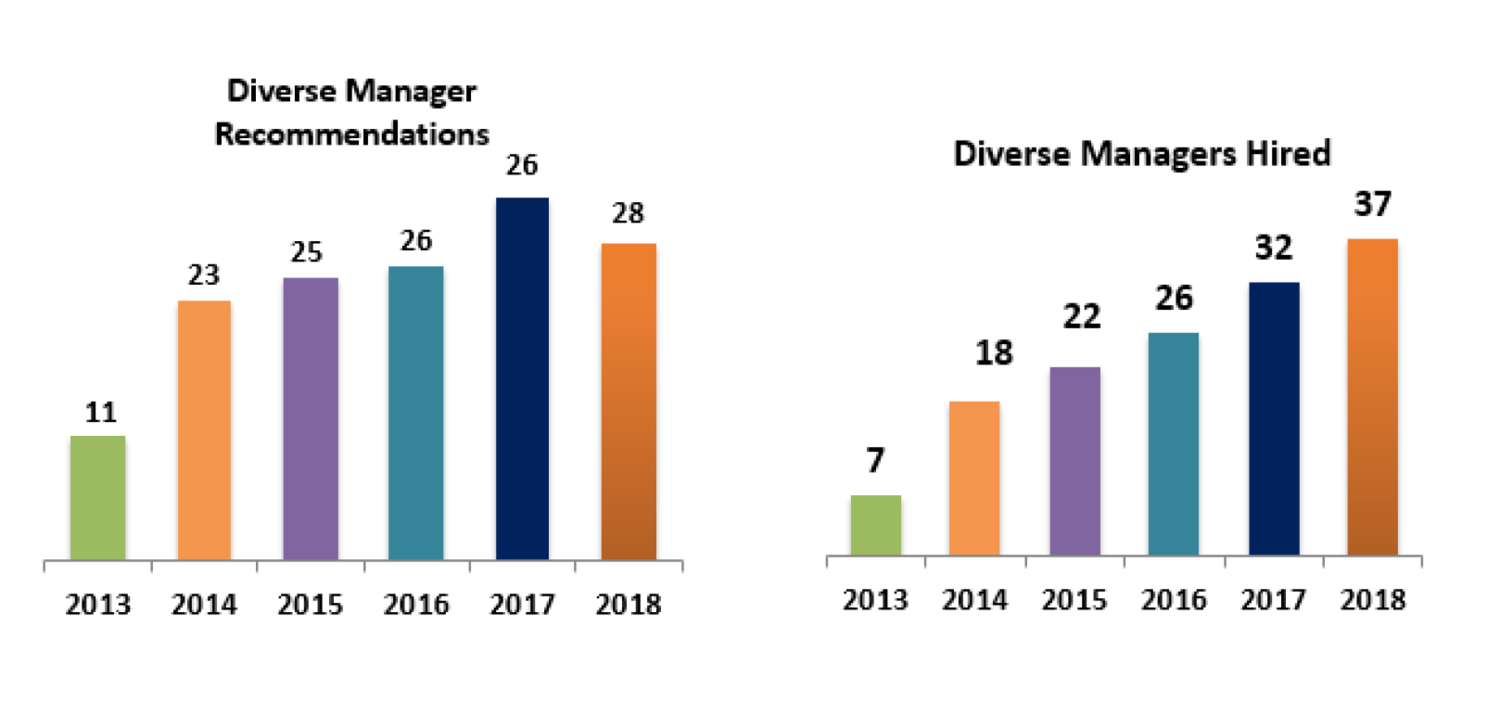

Additionally, investors are beginning to take issue with the lack of curated talent, which perpetuates the lack of diversity pipeline issue in investment management. Annually tracking the number of diverse manager meetings, recommendations and hiring is key. For Crewcial, it’s very simple, you measure what matters and, if one fails to do so, the end result is the status quo or a riskier or traditional portfolio because it lacks diversification by way of diversity of thought. Such oversight may also perpetuate inequality, which compromises our philosophy. Measuring and reporting allows us to see our blind spots and to hold ourselves accountable by ensuring we incorporate inclusivity. Diversification based on age, geography, different backgrounds, gender and ethnicity in order to build better portfolios is our ultimate goal."

- Angela Matheny, Head of Diverse Manager Equity at Crewcial Partners

Portfolio Advisors

Portfolio Advisors, LLC is an investment advisor that is committed to diversity initiatives. Portfolio Advisors does not evaluate investment opportunities on the basis of race, ethnicity, gender, sexual orientation or disability.

Georgetown University

Georgetown explores impact investing at the ‘Grade A’ level

By John L. Allen Jr. and Ines San Martin

Do you think that shapes investment decisions?

It most certainly does, and I think it could be shaped better if that percentage [of women] inched higher.

When you look at the percentage of senior staff at all of our investment firms who are minorities, that’s only at about 20 percent today. That number itself is probably a little bit misleading, because it includes groups such as Indian-Americans, so it doesn’t segregate out the numbers for African-Americans and Latino-Americans. The big problem is access to the financial services industry for people of color, and women as well.

We would want to expand the conversation, including by being a little bit public with our numbers. We hope that in addition to being the right thing to do, it can also lead to greater cognitive diversity across our investment firms, which ultimately leads to better decision-making processes and better returns.

The California Endowment

GOAL 11: Explore, review and consider efforts to promote diversity among investment managers

At the time of the last audit, TCE had recently completed an intensive search for minority-led and women-led investment managers. Since that time, TCE has been committed to maintaining the investment manager diversity that resulted from this intensive search.

Currently, TCE continues to engage with seven minority-led investment firms, identified prior to the previous DEI audit. The investment with these firms represents 6-7% of TCE's overall investments.

TCE has an ongoing priority for hiring diverse investment managers. Whenever a search for investment managers takes place, there is concerted effort to ensure at least one minority-owned firm is being considered.

In the updated TCE Investment Policy Statement (effective May 2017), TCE laid out five overarching goals for the years ahead, one of which focuses on strengthening the inclusion of women and minority-owned firms in the investment portfolio, and one focusing on the capacity of investment managers to incorporate Environmental, Social and Governance (ESG) principles into the investment process, specifically as they relate to TCE's values and mission.

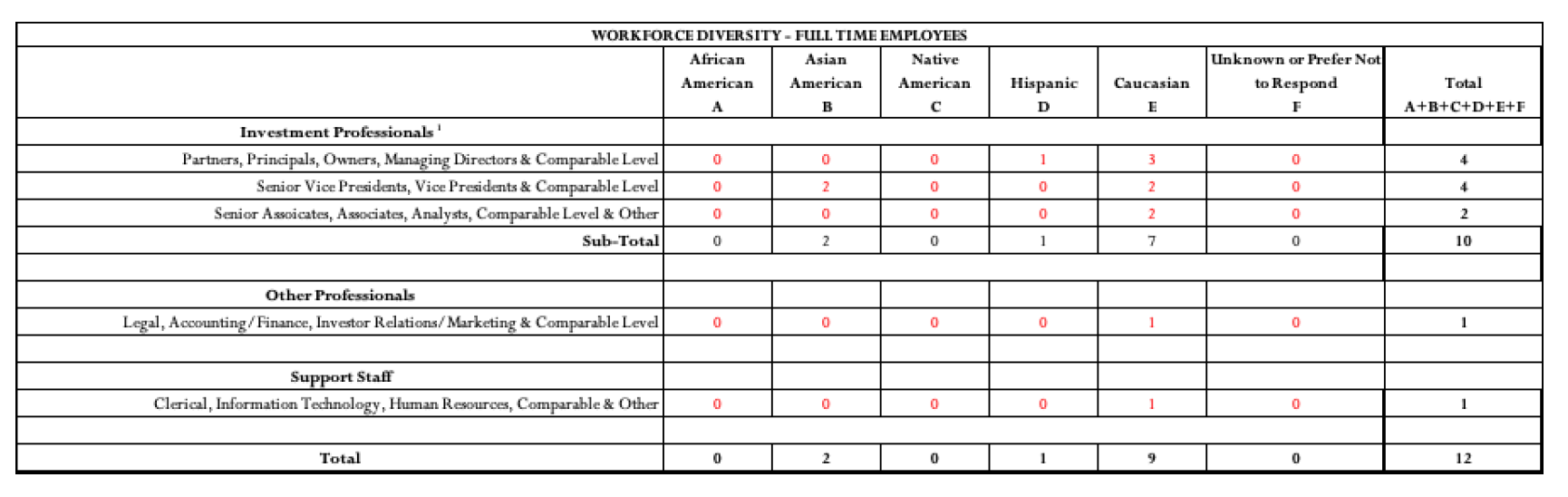

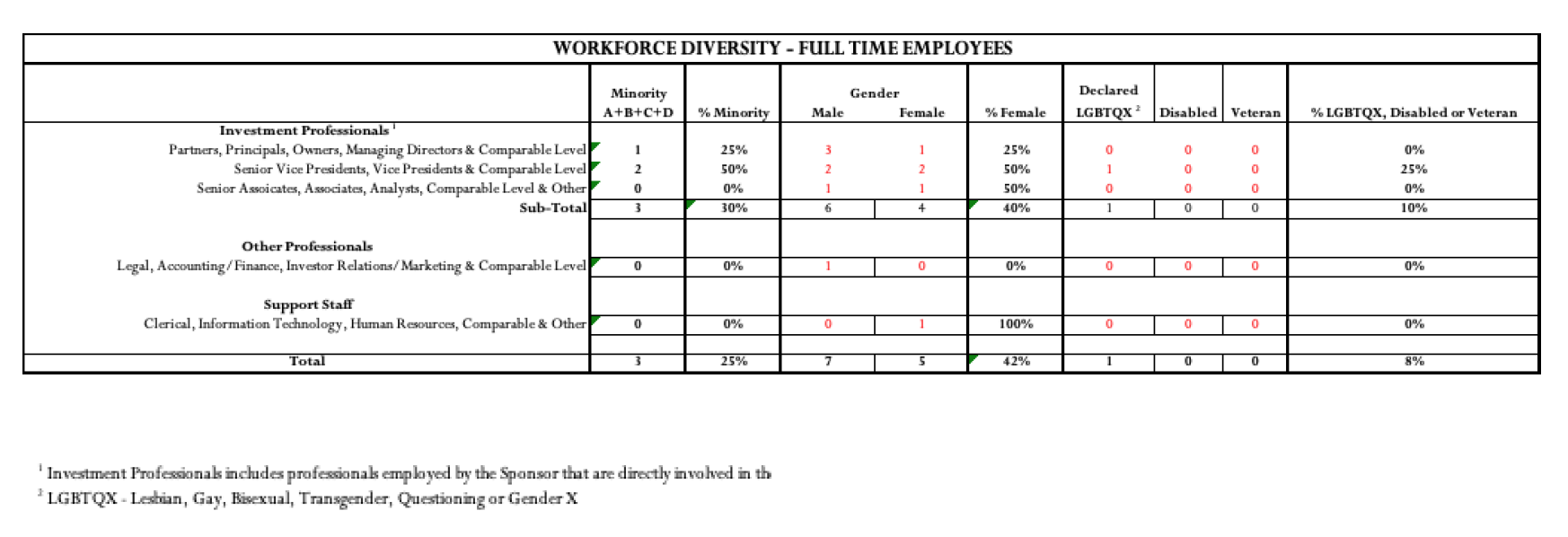

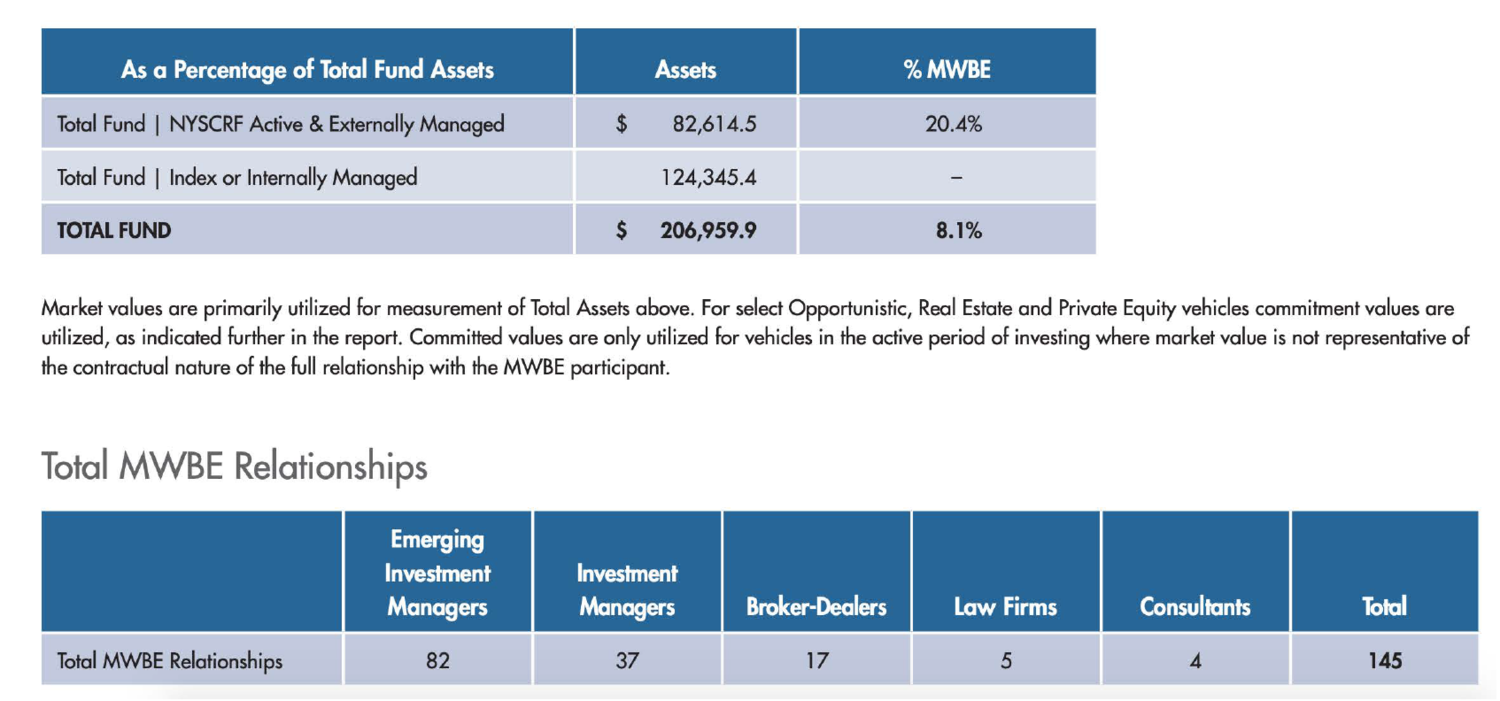

New York Common State Retirement

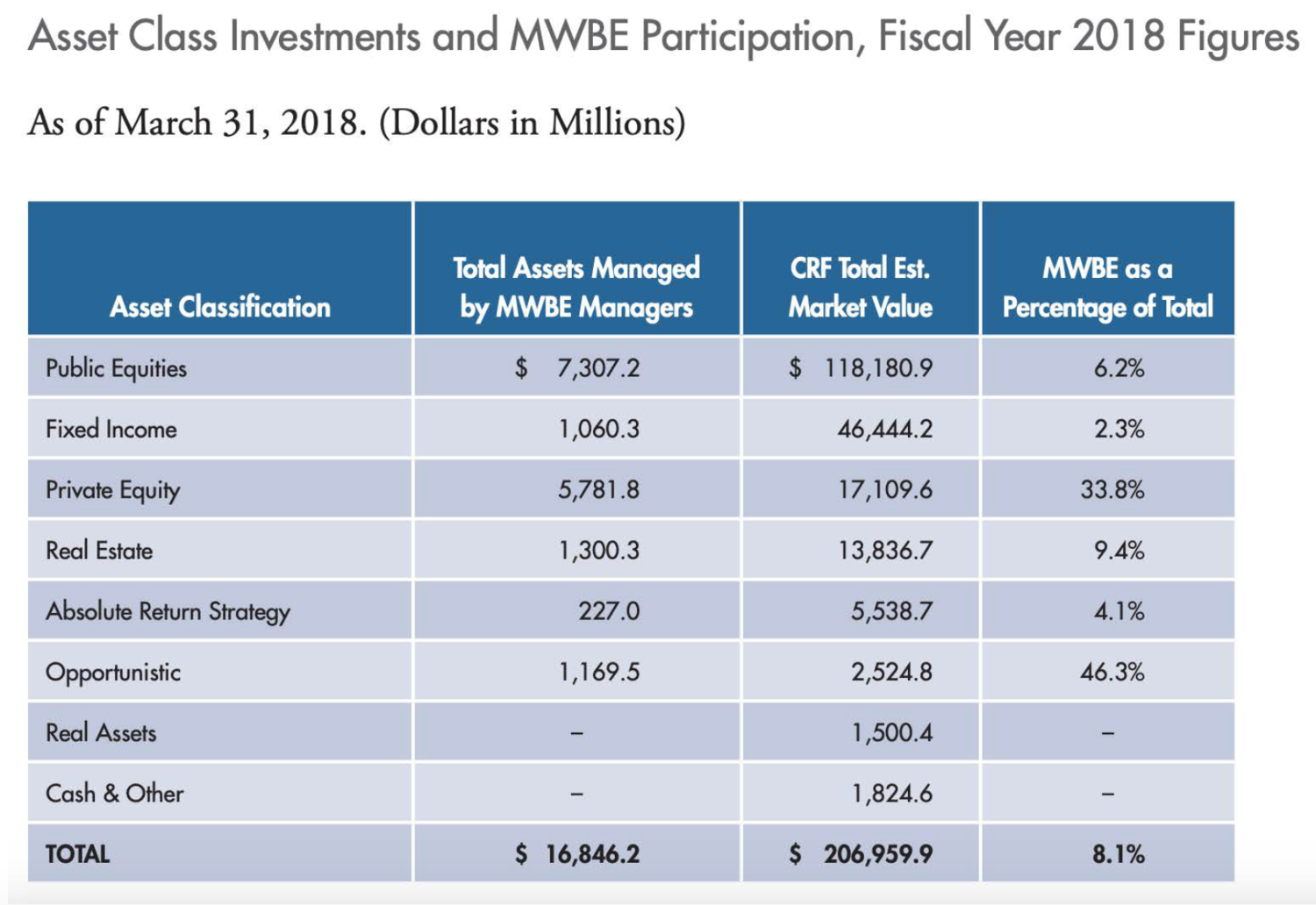

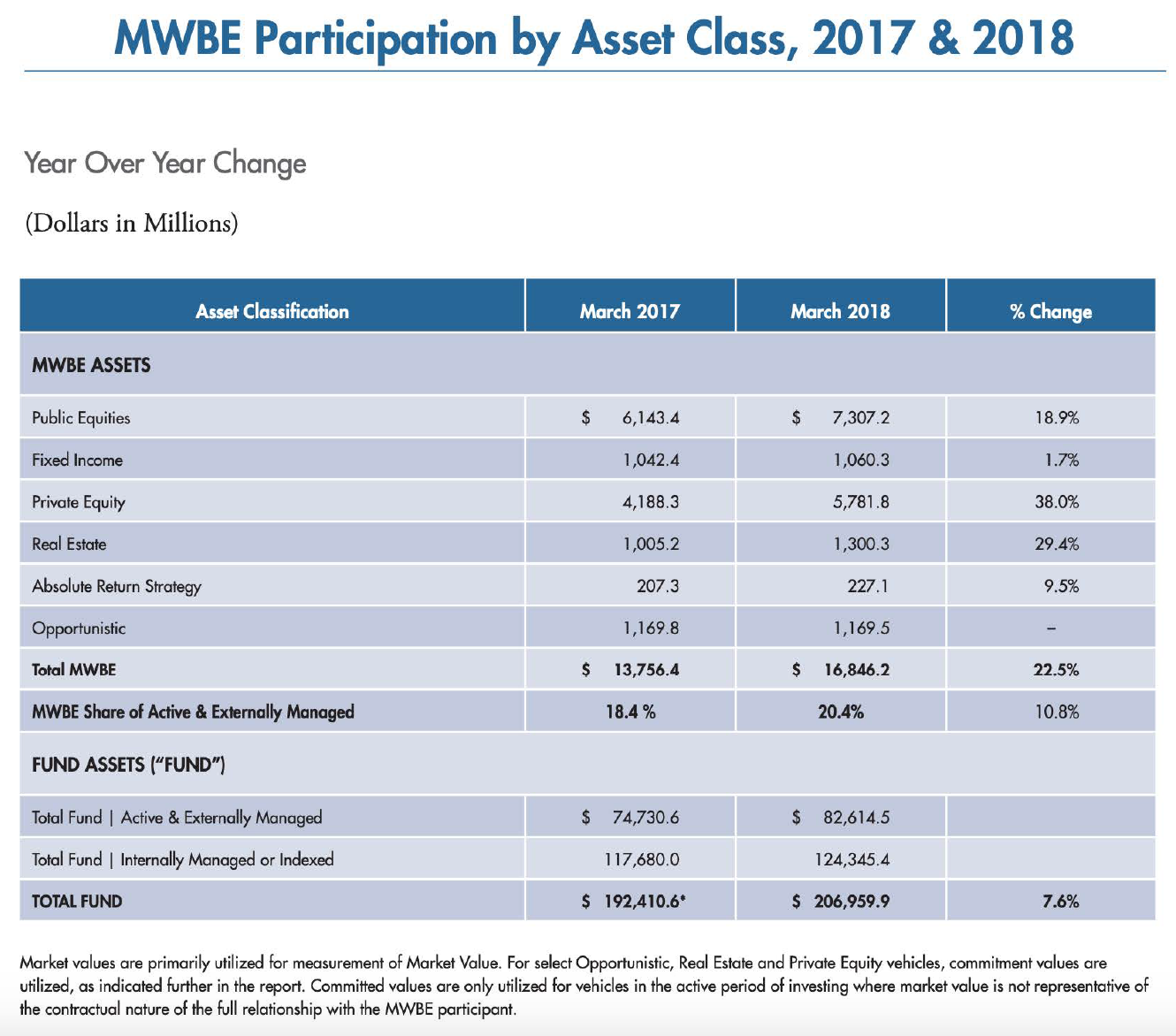

In the 2017-18 fiscal year, the Common Retirement Fund recorded robust growth in its investments with MWBE managers. As detailed in the tables below, total allocations, investments and commitments of Fund capital to MWBE partners rose from $13.8 billion to $16.8 billion, an increase of 22.5 percent.

Increases in value over the amounts reported in the previous year were particularly strong in Private Equity and Global Equities. Private Equity MWBE investments grew by over $1.5 billion, or 38 percent, including $200 million in new allocations to Vista Equity Partners, an additional $240 million commitment to Muller and Monroe and a $200 million commitment to Siris Capital Group. Global Equities increased by over $1.1 billion, or 19 percent, including new allocations to Channing Capital Management for $227 million and GQG Partners for $500 million. The Fixed Income and Real Estate asset classes also exhibited healthy growth in their assets placed with MWBE managers.

Last year’s growth reflects the cumulative effects of many years of sustained outreach to the MWBE investment community, publicizing and explaining opportunities to do business with the Fund through the Annual Conference and other venues, expanding our network, building relationships and allowing firms that have successfully managed small investments to take the next step up to handle larger amounts.

While Fund management is very pleased with these results, our team is committed to retaining their long-term focus on steady, incremental growth with successful managers.

The 2017-18 results illustrate another important measure of the success of the Fund’s MWBE Strategy. Of the $82 billion of Fund assets that are actively and externally managed, 20.4 percent have been allocated to minority or women-owned businesses.

Asset Class Total Investments

The charts on the following pages summarize the Fund’s current utilization of MWBE asset managers and broker/dealers. The broker/dealers are reported based on “MWBEs in Pool,” as they do not manage capital. They are tasked with executing trades on behalf of the Fund related to the assets that are traded in-house.